29

at a nascent stage contributing just about 1% of the total

revenue."With revenue generation to the tune of over Rs

12,600 crore, the bio-pharma sector comprises of vaccines,

therapeutics and diagnostics. While, India has emerged as

a leading destination for clinical trials, contract research

and manufacturing activities owing to the growth in the

bio services sector, which accounts for revenue generation

worth about Rs 3,800 crore.

Opportunities

Biopharma: Is estimated to reach USD 2.5 billion by 2015.

Majority of multinationals collaborate with major bio-

pharma companies for early stage clinical trials as well as

to sell the finished product for better market penetration.

Vaccines and recombinant therapeutics are the leading

sectors driving the biotechnologyindustry’s growth in

India. Protein and antibody production and the fabrication

of diagnostic protein chips are a promising area for

investment.

Bio Agri: Bio agriculture segment is estimated at $7.8

billion. The methods for grain production can address

the challenges in the food grain production. Technology

provides methods to improve the effectiveness of

agriculture inputs bring down input costs and increase

output.

Others: Some other potential areas of development

include bio-similars, stem cells, medicinal and aromatic

plants, animal biotechnology, aquaculture and marine

biotechnology, genome analysis and others.

Major Collaborations

Avesthagen, a Bangalore-based life sciences firm, has

announced the formation of a joint venture (JV) with

Limagrain, a French international cooperative group.

Limagrain will hold the majority 51 per cent in the JV, Atash

Seeds Pvt Ltd, to build agri-biotech business model for field

crops.

Bayer CropScience AG, a subsidiary of Germany-based

global crop sciences major Bayer AG and GVK Biosciences

Private Limited (GVK Bio) of Hyderabad, has entered into

a research cooperation agreement in the area of early

discovery chemistry.

Also, GVK Biosciences has partnered with the US-based

clinical organization, ResearchPoint Global. Together, the

two companies which are full service contract research

organizations (CROs) will offer access to medical writing,

clinical data management and biostatistics, as well as

quicker patient recruitment.

Biocon Limited, the country's second largest biotechnology

firm, has signed a Memorandum of Understanding (MoU)

with Malaysia's Biotechnology Corporation (BiotechCorp) to

explore collaboration and potential investment in Malaysia's

biotechnology industry.UK Trade & Investment (UKTI) and

the Association of Biotech-led Enterprises (ABLE) signed a

MoU to encourage anddevelop collaborative opportunities

between Indian Life Science organizations and companies

from the UK biotech industry.

Government Initiatives

Some of the initiatives taken by both Central government

and State governments that have provided a big boost to

the biotech industry in India are:

• Setting up a venture capital fund, to support small and

medium enterprises

• Good regulatory framework has been set up for approval

of GM crops and DNA products.

• India has a sound and widely acknowledged framework

of biosafety guidelines to deal with evaluation,

monitoring and release of genetically engineered

organisms and there are more than 106 institutional bio-

safety committees.

Major Investments

Some of the major investments in the sector are as follows:

Name of company Country

Investment

Place

Indian partner

Imac

USA

USD 104 mill

APIIC SEZ

Na

Indus

USA

USD 104 mill

APIIC SEZ

Na

Panacea Biotec Ltd India

USD 119.2 mill

Na

Na

Sanofi Aventis

France

USD 773.8 mill

Na

Bought ShanthaBiotechnics

Vibha Seeds Group India

USD 42.99 mill

Andhra Pradesh Na

Alexandria Real Estate USA

USD 107.48 mill

Gujarat

Na

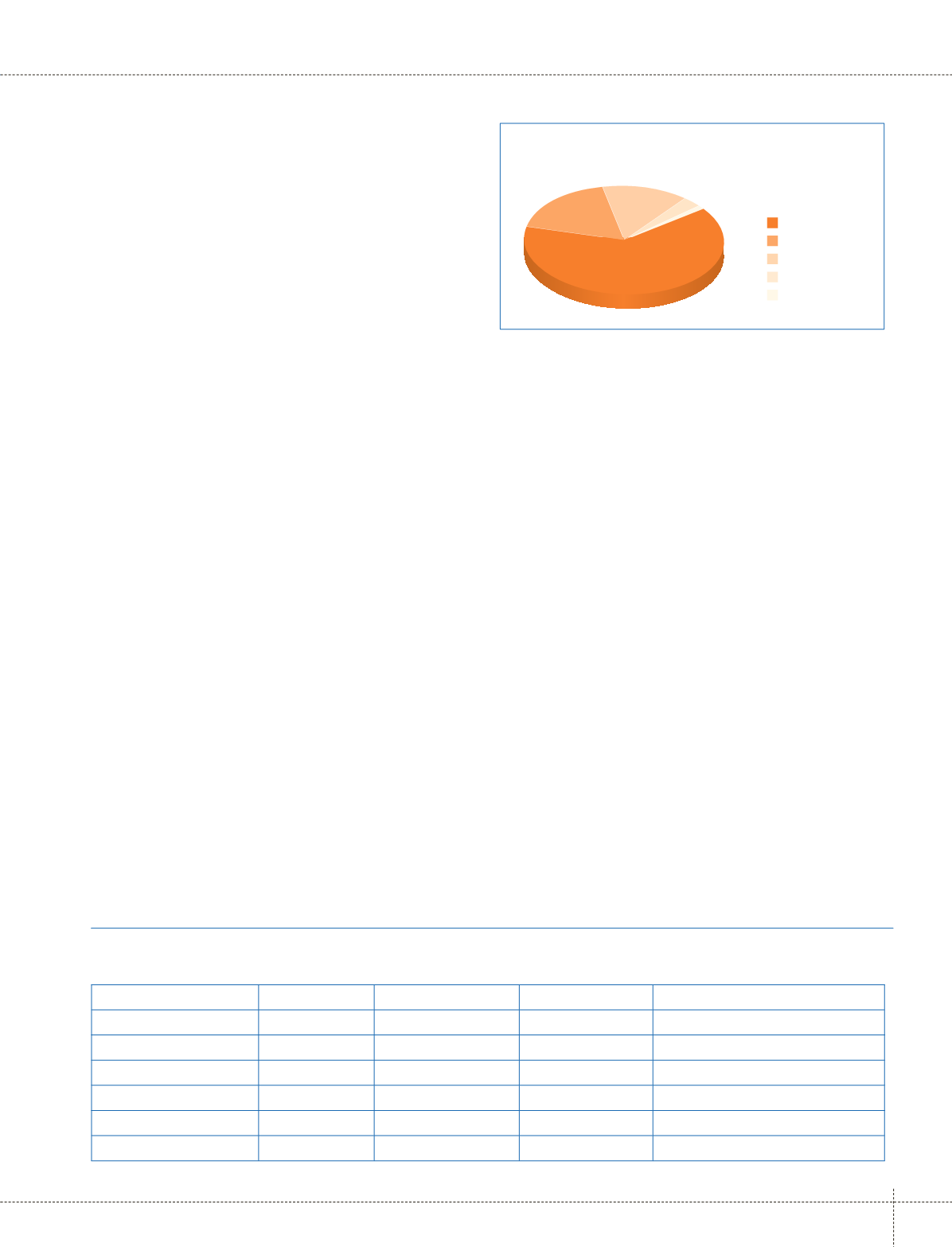

Market Break Up Revenue

64%

14% 18% 3%

Bio-service

Bio-Pharma

Bio-Agri

Bio-Industry

Bio-Informatics

1%