35

Demand Drivers and Key Concerns

The table below highlights the demand drivers and key

concerns arising from different sectors

Sector

Demand Drivers Key Concern

Domestic

• Population

growth Increased

per capita water

consumption

• Absence on

regulatory

binding on

usage and

wastage of water

Industry

• Expansion of

water intensive

industries like

power, iron &

steel, chemical

leading to

increase in water

demand

• Absence of loss

monitoring and

subsequent

reduction

• scheme

Agriculture

• Domestic food

grain demand

increasing with

increase in

population

• Demand for

water intensive

crops like

wheat, rice

are increasing

substantially

• Poor water

management

• Over-

exploitation of

ground water

• Reduction of

ground water

levels due to

climate change

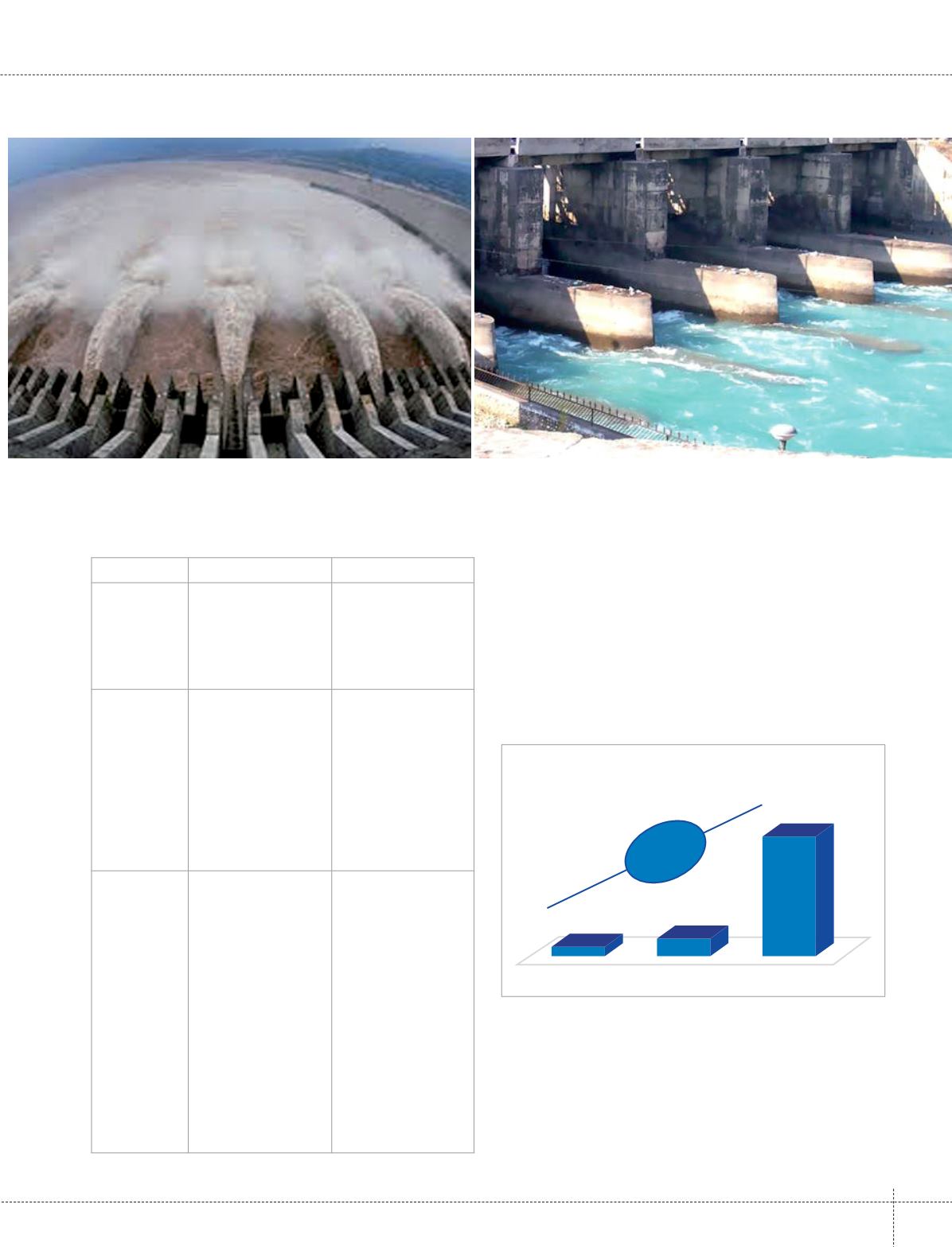

Investment trend in Infrastructure, Sewage, and

Sanitation Services

India is the world’s second largest water consuming

country. The government’s spending on irrigation in India

is expected to be US$17.5 billion in 2012. With a market

size of over US$4 billion, the Indian water and wastewater

market is growing at the rate of 10%–12% every year.

Government-related projects contribute over 50% of the

revenues generated by this market, while the private

sector contributes the rest. The water and wastewater

treatment market segment is highly fragmented and

unorganized.

The Indian water market is $ 30 billion sized and, by

2030, this potential shall revolve around four key themes:

equipment supply, public private partnerships for water

supply and distribution, water treatment plants and water

EPC (engineering, procurement, and construction) business

and integrated water resource management for utilities.

Source: Planning Commission and Tata Strategic Analysis Infrastructure

2,015

2,030

45.6

6.73

3.56

2,010

Annual Investment potential in water infrastructure

in India (US $Bn)

CAGR

14%